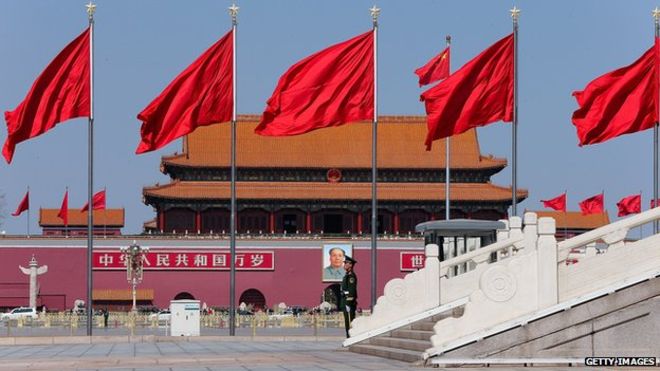

Investors are braced for further losses in China, after its stock markets fell 12 percent last week.

Investors are braced for further losses in China, after its stock markets fell 12 percent last week.

Stock markets around the world fell on fears of a slowdown in the Chinese economy and the knock-on effects for the global economy.

Earlier this month, the country’s central bank announced measures to devalue the country’s currency, the yuan, seen widely as a move to help Chinese exports.

Joe Lynam reports.

Stock markets in the Middle East have fallen sharply after a difficult week for all major global share indexes.

The Dubai Financial Market closed down 7%, while the Saudi exchange also lost 7% after Fitch ratings agency cut its outlook for the country.

Last week, the Dow Jones in the US fell 6%, while the UK’s FTSE 100 posted its biggest weekly loss this year of 5%.

Investors are concerned about a slowdown in China and the knock-on effects for the global economy.

Both France’s Cac 40 and Germany’s Dax indexes lost 7% of their value last week.

In the Middle East, there is particular concern about low oil prices, which are down by more than a half this year and have been falling steadily since May, when Brent Crude stood at $68 a barrel. A barrel now costs $45.

This is mainly due to an abundance of supply, in large part from from US shale oil producers, which are weakening OPEC’s once dominant position in global oil markets. Saudi Arabia, Iraq, Kuwait, Qatar and the United Arab Emirates are all members of OPEC.

Moods were further dampened by a report from Fitch which cut the agency’s outlook on Saudi Arabia from “stable” to “negative”. The move reflects concerns about the future of the country’s finances, which are heavily dependent on revenues from exporting oil.

These worries come against a backdrop of falling global stock markets, reflecting widespread fears about the pace of the slowdown in the Chinese economy.

On Friday, figures from the world’s second largest economy showed that factory activity in August shrank at its fastest pace in more than six years.

The data triggered another sell-off in Chinese shares, which ended the day down more than 4%, and 12% on the week.

Earlier this month, the country’s central bank announced measures to devalue the country’s currency, the yuan, seen widely as a move to help Chinese exports – a weaker yuan makes Chinese goods cheaper overseas.

This came after official figures showed the country’s economic growth continuing to slow. For the three months to the end of July, the economy grew by 7% compared with a year earlier – its slowest pace since 2009.